Pinellas County Response to Florida DOGE Letter

August 6, 2025

Dear Florida DOGE Team,

Thank you for your ongoing commitment to supporting good governance in Florida. Your efforts to promote efficiency, maximize effectiveness, and uphold fiscal responsibility are appreciated, which is why the board adopted Resolution 25-31 in support of Florida DOGE efforts. We share your commitment and have implemented efficiency and cost saving measures as part of our annual budget process, which is how we have been able to reduce our property tax rate for three out of the past five years. While expenditures have increased over time, it will be demonstrated those additional expenditures are primarily directed towards the shared community priorities of public safety, investment in critical infrastructure, and responsive service delivery. The Pinellas County Commission is dedicated to transparency, accountability, and operational efficiencies and we welcome your collaborative input with lessons learned from other local governments.

As outlined in the attached documents, we have invested in public safety by increasing the annual budgets for the Pinellas County Sheriff’s Office to fund annual salary increase to remain competitive with other law enforcement agencies, as well as state-mandated increases to the Florida Retirement System (FRS). We have also invested in our roads and bridges. Locally, we are not able to index our local gas tax to keep up with inflation like the state is, so we had to implement three separate property tax transfers to maintain our roads and bridges. Even while reducing our property tax rates, we have funded the above expenditures while also continuing to bear unfunded mandates for the Supervisor of Elections, Human Services, Courts, Juvenile Detention and Medicaid of more than $20 million per year. Additionally, Pinellas County has the lowest level of debt among our peer counties; our debt is less than $70 million and is totally funded by user fees, not ad valorem revenue. All of these illustrate our fiscal responsibility.

Site Visit

As requested in your letter dated July 28, 2025, we have designated a point of contact for your visit on August 7 and 8. Jim Abernathy, Operating Budget Manager in the Office of Management and Budget, will be your primary contact and will accompany you during your visit. We have reserved space at 315 Court Street, 4th Floor, Clerk’s Large Conference Room, in Clearwater, Florida.

In response to your request for items relating to various time frames between FY20 to the present, we are compiling the information and will have the results ready before or upon your arrival.

Item Counts

Please note: Many of the following are not funded by the General Fund or ad valorem property taxes.

- Procurement and Contracting: Nine Requests

- Personnel Compensation: Eleven Requests

- Property Management: Three Requests

- Utilities System: Two Requests

- Diversity, Equity, and Inclusion: Fourteen Requests

- Green New Deal: Six Requests

- Grants and Other Spending: Five Requests

- Transportation: Seven Requests

- Financial Management: Three Requests

We do not maintain detailed records for the constitutional officers of Pinellas County, so our response is limited to records of the Board of County Commissioners, including all County departments under the County Administrator and the following Appointing Authorities: Business Technology Services, County Attorney, Human Resources, and the Office of Human Rights. All response time frames are for FY20 up to and including FY24 unless otherwise specified in your letter. The default reporting date for Payroll system information corresponds to the calendar year ending December 31st.

General Fund ad valorem revenue

Your letter, dated July 28, 2025, references the county’s rising property values and their impact on ad valorem revenue. General Fund ‘annual property tax collections’ increased by $144 million (31%) since FY20, not ‘$220 million’ as stated in your letter. This is lower than the rate of increase in taxable values in the county ($38 billion or 45%). During the same period, our Commission voted to decrease the Countywide millage rate by 0.5357 mills (10%).

General Fund Expenditures

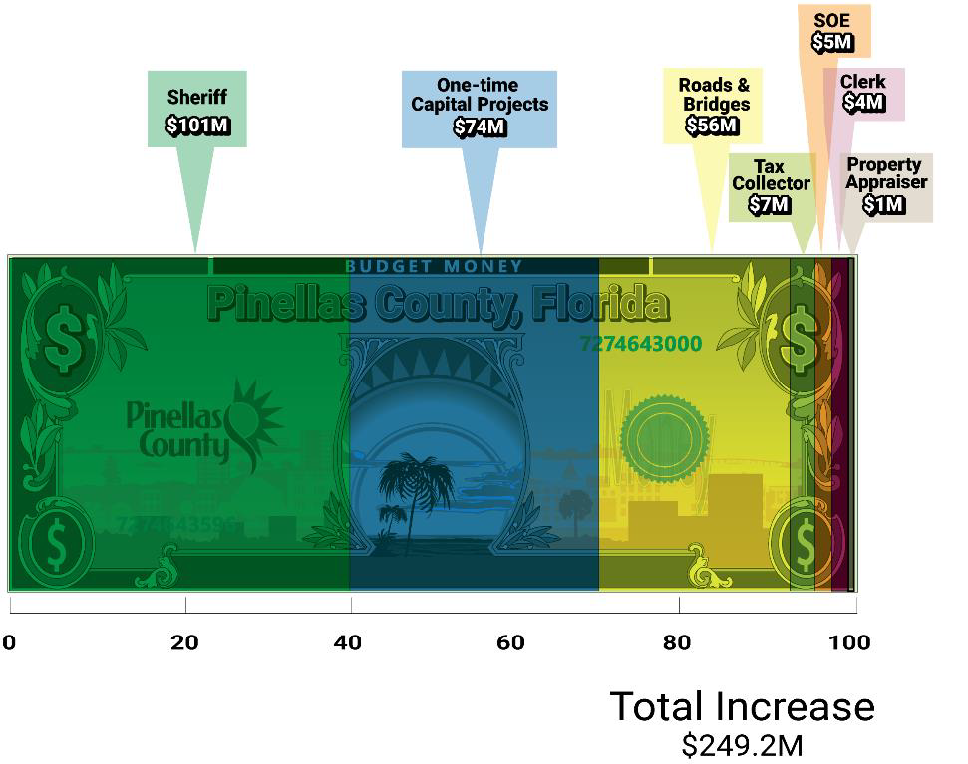

Your letter also references an increase in General Fund expenditures of approximately $330 million (43%) since 2020, while in fact expenditures only increased $249 million (37%) over that period. It appears this calculation relates to the adopted budget/appropriations rather than actual expenditures, which we have outlined in the General Fund Expenditures by Group table below, comparing the FY24 General Fund Expenditures to FY20.

General Fund Expenditures by Group

| FY24 | FY20 | $ Change | % Change | |

|---|---|---|---|---|

| Board of County Commissioners | $2,468,541 | $2,075,722 | $392,819 | 19% |

| County Attorney | $5,917,977 | $5,306,966 | $611,011 | 12% |

| County Admin Depts | $191,113,238 | $164,494,906 | $26,618,332 | 16% |

| Sheriff | $421,038,235 | $319,821,355 | $101,216,880 | 32% |

| Clerk of the Circuit Court | $17,662,510 | $13,151,160 | $4,511,350 | 34% |

| Supervisor of Elections | $15,153,860 | $10,127,320 | $5,026,540 | 50% |

| Tax Collector | $28,506,369 | $21,356,478 | $7,149,891 | 33% |

| Property Appraiser | $12,891,531 | $11,673,936 | $1,217,595 | 10% |

| Support Funding | $91,872,204 | $118,247,182 | ($26,374,978) | -22% |

| Total expenditures | $786,624,465 | $666,255,025 | $120,369,440 | 18% |

| Transfers Out | $138,712,562 | $9,910,800 | $128,801,762 | 1300% |

| Total Expenditures with Transfers | $925,337,027 | $676,165,825 | $49,171,202 | 37% |

*Transfers Out include $74 million for One-time Capital Projects, $56 million for the dedicated transportation infrastructure millage (i.e. Roads & Bridges), $4 million General Fund subsidy for the E911 Fund, and other smaller transfers.

DOGE’s evaluation of whether County expenditures represent excessive spending requires thoughtful analysis and consideration of the broader context and contributing factors.

Constitutional Officers

- Approximately 46% of total General Fund expenditures fund the Sheriff’s operations. The Sheriff is a separate constitutional officer whose office maintains separate detailed records.

- General Fund transfers to the Sheriff increased $101 million (32%) from FY20 to FY24.

- Personnel costs increased $62 million (23%), which include salary increases of $37 million (20% increase), health insurance increases of $3 million (7% increase), and State-required and State enhanced FRS benefits increases of $21 million (60% increase).

- Annual salary increases have been necessary to retain both sworn and non-sworn staff and to keep compensation competitive with other law enforcement agencies when hiring.

- FRS rates are set annually by the Florida Legislature and are beyond the control of Pinellas County.

- General Fund transfers for Other Constitutional Officers increased as follows:

- Clerk of Circuit Court and Comptroller: $4.5 million (34%)

- Property Appraiser: $1.2 million (10%)

- Tax Collector: $7.1 million (33%)

- Supervisor of Elections: $5.0 million (50%)

Since FY20, SOE has spent more than $2 million to enhance and maintain cybersecurity protocols to stay in compliance with the State Cybersecurity Act, add four positions to fulfill duties previously completed by the Florida Department of State, and complete other required enhancements to guarantee the integrity of the Vote in Pinellas County.

Other Transfers related to Transportation & Capital Improvements, including a land purchase for a new county complex ~

- General Fund transfers to the County Transportation Trust Fund increased by $56 million between FY20 and FY24. These transfers were funded by a Board-designated millage rate to support transportation infrastructure, and a one-time amount that was necessary due to the Transportation Trust fund not being sustainable. State law prohibits the county from indexing the fuel tax to fund these much-needed infrastructure projects. The Commission reduced the overall county millage rates despite these dedicated transportation infrastructure millage rates.

- General Fund transfers to the County Capital Projects Fund increased $74 million between FY20 and FY24. This transfer fluctuates significantly each year and is based on project requirements, including the purchase of land for the county’s new administrative campus. The investment in the new campus will decrease expensive maintenance of obsolete buildings and will return many current county properties to the tax rolls.

Other ~

- Florida Retirement System contributions, excluding the constitutional officers, amount to $11 million in FY24. This represents a $5 million (71%) increase between FY20 and FY24.

Pinellas County has faithfully assessed community priorities and allocated additional resources accordingly, particularly with respect to public safety, investment in critical infrastructure, and responsive service delivery. Concerning the five-year increased expenditures of $249 million detailed above, $101 million was spent towards the Sheriff’s operations, $56 million for roads & bridges, and $74 million for one-time capital projects. These critical community priorities account for 93% of the additional expenditures. We look forward to discussing your observations and reviewing these impacts in more detail. All best practices identified through the DOGE efforts will be evaluated for cost-benefit impacts and community support. Please do not hesitate to reach out should you have any questions or require further clarification prior to your arrival.

Sincerely,

Brian Scott, Chairman

Pinellas County Board of County Commissioners

Cc:

Ken Burke, CPA, Clerk and Comptroller to the Board of County Commissioners

Jeanette L. Staveley, CPA, CGFO, Chief Deputy Director, CCC Finance Division

Barry Burton, County Administrator

Blaine Williams, Assistant County Administrator

Chris Rose, Director, Office of Management & Budget, BCC

Enclosure: Letter dated July 28, 2025, from the State of Florida, Executive Office of the Governor