Consequences of Non-Compliance with NFIP Regulations

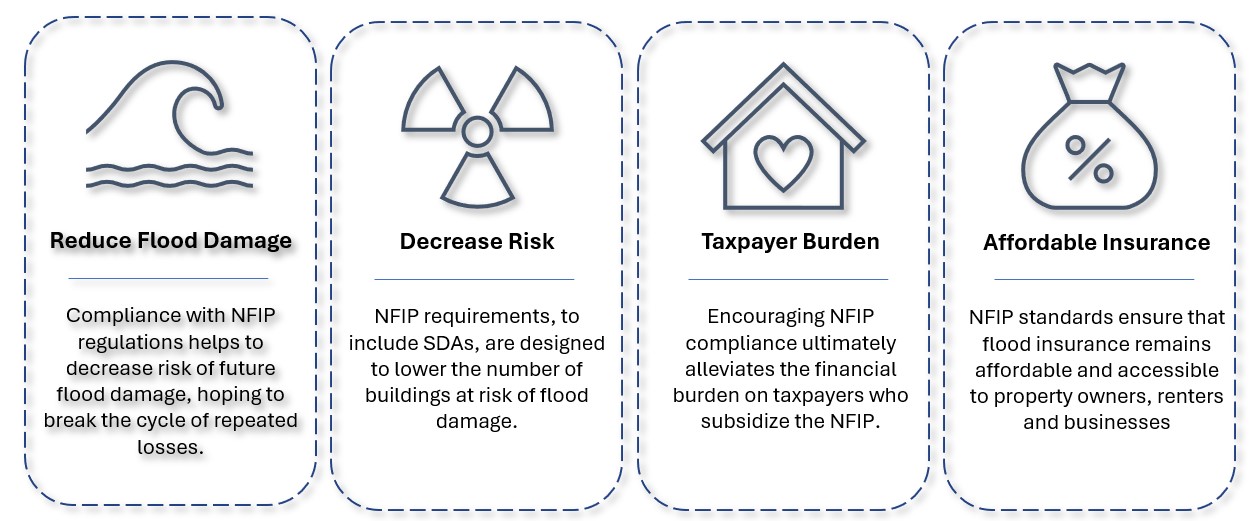

Why does FEMA require a Substantial Damage Assessment?

Often known as the “FEMA 50% Rule,” federal floodplain requirements for major improvements or repairs for cities and counties across the country make communities eligible for NFIP flood insurance and other critical programs.

Consequences of non-compliance may include…

- Cities or Counties may face probation or suspension from the NFIP.

- Homeowners could lose access to federally regulated mortgages and face foreclosure.

- Loss of eligibility for federal funding (e.g. Hazard Mitigation Grant Program, Flood Mitigation Assistance).

The County faces the following risks if suspended from FEMA National Flood Insurance Program:

- Loss of Mortgage Access: No mortgages will be available from banking institutions insured and regulated by the Federal Deposit Insurance Corporation (FDIC) within Special Flood Hazard Areas (SFHA).

- Ineligibility for Federal Grants: The local government will not be eligible for any federal grant programs that benefit infrastructure within SFHA zones. Must return federal active grants currently in process that benefit SFHA zones, including the Department of Housing and Urban Development’s (HUD) Community Development Block Grant Disaster Recovery (CDBG-DR) program. This restriction hinders the community’s ability to fund recovery and rebuilding initiatives.

- Increased Financial Burden on Residents: The combined effects of these limitations will exacerbate the financial strain on residents, particularly due to the rising cost and limited availability of private flood insurance coverage.