Electronic Form 1095-C Opt In

2026 Update

The deadline to opt in to receive your 2025 Electronic Form 1095-C was January 31. If you did not opt in, you will receive a copy by mail.

The 2025 Form 1095-C will be distributed to employees by March 2. Human Resources will send an email notification to all employees when the form is available.

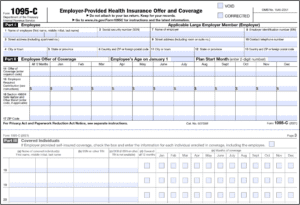

Pinellas County offers employees the option to opt in to an electronic version of the Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) instead of a mailed copy. This option is approved by the Internal Revenue Service (IRS).

- Form 1095-C provides information about the health insurance coverage provided by Pinellas County.

- The IRS advises you keep a copy of any 1095s you receive with your tax records, but you are not required to submit your Form 1095-C with your tax return.

- The Human Resources Benefits team distributes Form 1095-C to employees by March 2.

- You will get an email from Human Resources when the form is available to view and print.

- Your consent to receive an electronic 1095-C will be valid for all subsequent tax years unless you change it in EBS (OPUS).

How do I opt in to an electronic 1095-C?

- Log into EBS (OPUS).

- From the menu at top left (3 lines), select PIN Employee Self Service and ACA 1095C Statement.

- Read the consent, and click the Consent to Receive an Electronic Copy checkbox.

- Click Save and Next.

- Choose the Year from the drop-down menu and click Go.

- Click View Latest PDF.

- If the PDF does not open, look at the field at the top of your screen where the website URL is listed, and to the far right of the URL, click the icon of a folder with a line through it. Select Always allow pop-ups, and click Done.

How do I view my electronic 1095-C?

If you opted in for electronic access, you may access the form in EBS (OPUS) from 2023 to the present:

- Log into EBS (OPUS).

- From the menu at top left (3 lines), select PIN Employee Self Service and ACA 1095C Statement.

- Select Next.

- Choose the desired year from the drop-down Year menu.

- Select Go.

- Click the View Latest PDF to view, download, or print the form.

Can I opt in to receive my electronic Form 1095-C any time?

Yes. You can opt in at any time during the year for electronic delivery of your Form 1095-C. Once you have given consent, your forms from 2023 to the present will immediately be available in EBS (OPUS).

What happens after I opt in to an electronic version?

- You will no longer receive the Form 1095-C in the mail.

- You will be notified by email when your form is available for viewing in EBS (OPUS).

You only need to complete the opt in steps listed above once to give consent to receiving the form electronically from now on.

What are the advantages of an electronic 1095-C?

An electronic version offers convenient 24-hour availability, early access (no need to wait for mail delivery), and environmental savings by eliminating the need to print and mail a paper form. You can view or print the electronic form as desired.

What if I do not opt in (i.e. I prefer a mailed copy)?

- If you prefer receiving your Form 1095-C by mail, no action is needed.

- You will receive a mailed copy each year at the address listed in EBS (OPUS) by the IRS deadline which is March 2.

- If you have an address change in the future, update EBS (OPUS) promptly with your new address to ensure that you receive your form in the mail.

- NOTE: If you do not opt in to the electronic form, you will not be able to view them in EBS (OPUS).

What if I opt in and then change my mind?

You can change your election at any time. If you decide you would like a mailed Form 1095-C instead of an electronic copy, follow these steps:

- Log into EBS (OPUS).

- From the menu at top left (3 lines), select PIN Employee Self Service and ACA 1095C Statement.

- Read the Electronic Delivery Consent information.

- Click the Revoke Consent button.

- Select Yes.

If you change your election, it will be effective the day you make the change in EBS (OPUS) and will apply to future forms only.

Do I have to opt in every year?

No. You only need to opt in once and then all future forms will be available for electronic viewing in EBS (OPUS).

What if I leave Pinellas County employment?

No action is needed on your part. When you leave Pinellas County employment, you will not have access to EBS (OPUS) so you will automatically be mailed a paper copy of your last form.

Will I be able to view my Form 1095-Cs online if I don't opt in?

No. The IRS requires that we get your permission before we are able to post forms online.

What if I have questions?

Please contact Benefits at (727) 464-3367, option 1 or email employee.benefits@pinellas.gov.

Also see Electronic W-2.

2/2/26