Medical Coverage

2026 Changes

- For the High Deductible Health Plan with HSA, there are IRS-mandated changes to the contributions, deductibles, and out-of-pocket maximum limits.

- Access to the Teladoc Primary360 program which offers virtual primary care doctors including an annual visit, lab orders, prescriptions, and referrals.

Pinellas County provides medical coverage to its employees through UMR (UnitedHealthcare). Two plans are available as detailed below. Medical coverage is available to all permanent and long-term temporary employees scheduled to work a minimum of 20 hours per week.

Contact UMR

Contact UMR via phone, web, or app to:

- Consult with a nurse

- Get claims information

- Ask questions about coverage

- Request an ID card or print your own

- Find a doctor or hospital

- Learn how to lower out-of-pocket costs

- Schedule a virtual doctor visit (Teladoc)

- View preventive care guidelines

- Website: www.UMR.com

See UMR Login for step-by-step instructions. View medical and wellness information with the same login/account.

- App: UMR Health

- Phone: (866) 783-6467, option 1, available 24/7 to speak with the GenerationYou team of nurses and social workers

- UMR onsite representatives are available in-person or by phone.

Medical Plan Options

- Preferred Provider Organization (PPO)

- Summary of Benefits and Coverage

- Plan Description (combined for PPO and HDHP)

- High Deductible Health Plan (HDHP) with HSA

- Summary of Benefits and Coverage

- Plan Description (combined for HDHP and PPO)

- Health Savings Account

Additional medical plan information is available upon request for residents outside of Florida.

Medical Plan Biweekly Premiums

Both plans offer the same low premiums which includes medical care, prescription coverage, behavioral/mental health and vision care:

| Coverage | 2026 Biweekly Cost |

| Employee Only | $13.09 |

| Employee and Spouse or Domestic Partner | $151.16 |

| Employee and Child(ren) | $120.60 |

| Family | $247.67 |

- View machine-readable files in JSON format for researchers, regulators, and application developers. Search for “Pinellas-County-Government”.

Plan Comparison

- Both plans are administered by UMR.

- Both plans offer both in-network and out-of-network benefits.

- Both plans have the same network of hospitals and doctors.

- Both plans are open access, which means you may use any network physician, you do not have to select a primary care physician, and you do not need a referral to see a specialist.

- Both plans cover the same benefits, limitations, and exclusions.

- There are some distinct differences so please compare the plans carefully.

Comparison Chart

Additional Benefits

All employees and dependents who enroll in one of the medical plans are provided the following coverage:

Spotlight on Hinge Health

Hinge Health is a free virtual therapy program to support muscle and joint health. The personalized program provides a care team (via video) which may include a licensed physical therapist and exercise kit with wearable sensors.

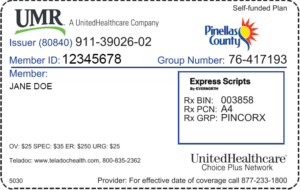

ID Cards

You may access your ID card on the UMR website or app.

UMR mails ID cards to new employees, those who change their benefits, and all employees on the High Deductible Health Plan. You can request additional copies if needed.

Effective Date of Coverage

- Start Date: Coverage is effective for new employees on the first day of the month after 30 days of employment. For example, if you are hired on February 16, your benefits are effective on April 1.

- End Date: Your benefits coverage through the County ends on the last day of the pay period in which your separation occurs. For more information, see Employee Benefits: What Happens When I Leave?

Pre-Authorization

Some medical procedures, imaging, treatments, medications, and equipment need approval from UMR before you receive care. View Pre-Authorization FAQs to learn about the process and what to do if authorization is denied.

Tax Saving Plans

Reduce your healthcare costs with the following options:

- Flexible Spending Accounts – Pinellas County offers FSAs to help you reduce out-of-pocket expenses for healthcare expenses (for employee and dependents) or dependent care expenses such as daycare costs by paying for them on a pre-tax basis. You do not have to be enrolled in the Group Health Plan to participate.

- Health Savings Account – An HSA is a tax-deductible savings account available to individuals enrolled in an IRS-qualified high-deductible health plan like Pinellas County’s High Deductible Health Plan (HDHP) with HSA.

- Pre-Tax/Payroll Deductions – Payroll deductions for health and dental coverage may be deducted under the provisions of the Internal Revenue Service Tax Code, Section 125. Each year, during the County’s Annual Enrollment period, you have an opportunity to elect pre-tax health or dental premiums.

Enrollment

Important Links

1/5/26